Functional Cost Controlling

Integrated usage of functional areas for P&L and functional cost controlling with SAP S/4HANA

The complexity of business functions and the increase of functional costs is a steering relevant issue in numerous companies. The consistent usage of SAP functional areas can support this important business control topic. Basically, a functional area is an assignment characteristic in SAP that breaks down revenues and operating expenses by function to fulfil the requirements of cost of sales method for external and/or internal P&L. From the legal perspective such as IFRS or local GAAP the use of functional areas as revenue, COGS, selling cost, general administration and other operating income/expenses is sufficient.

However, detailing these functional areas according to relevant corporate steering requirements would increase the information content and enable further control options for both functional costs and internal P&L. While in SAP ECC cost of sales method required a special ledger, with S/4HANA all data is completely integrated in the Universal Journal (ACDOCA). Hence, total-cost-method and cost-of-sales-method can be organized in parallel in Universal Journal.

First functional areas serve to build P&L according to the cost of sales method

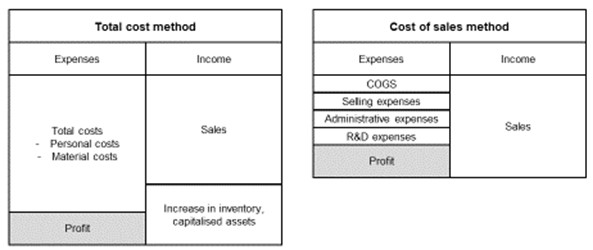

In principle, a company’s income statement can be prepared using two different representation methods. The total cost method or the cost of sales method, whereby the cost of sales method is the standard in many companies. In Germany, legislation allows both forms. Companies that prepare their accounts in accordance with IFRS also have a choice of both techniques. In contrast, the cost of sales method is mandatory for accounting in accordance with US GAAP. The total cost method compares sales and inventory change with the expenses of a period using accounts. The cost of sales method depicts the sales revenue of the accounting period with the cost of sales incurred for the sold products or services by structuring the cost of sales functionally. An example of the structure of the cost of sales method in HGB accounting are beside revenues the functions COGS (manufacturing), selling expenses, R&D expenses, and administration expenses. The functional breakdown of cost of sales accounting enables to report what costs are incurred for and thus represents the economic purpose of expenses. In principle, cost-of-sales-accounting can be represented in SAP in different ways and the functional areas are the main object in SAP to structure cost-of-sales-reporting. Functional areas can be assigned to SAP controlling objects, G/L accounts and cost elements. In addition, functional area derivation via substitution technique is possible in the system.

Figure 1: Total cost method vs. Cost of sales method

In the former SAP software generations companies must choose the cost of sales ledger for legal reporting and classic profit centre accounting for internal management cost of sales views. Moreover, for further Controlling purposes an additional way of representing cost of sales method is cost based profitability analysis (CO-PA) which is in place from SAP R/3 until S/4HANA. In cost-based CO-PA the functional views are normally designed and represented with so-called value fields and specific value flows must be designed in SAP according to the defined structure of the cost-based profitability analysis.

With development of New General Ledger in SAP ECC the functional area object is integrated in general ledger and could be used there for legal and profit centre reporting requirements. This results in less reconciliation effort between legal and profit centre cost of sales reporting.

With S/4HANA, SAP introduced above mentioned Universal Journal as a major innovation within S/4HANA, because it breaks down the separation between controlling and finance that used to exist in sap systems and brings the two worlds together in one single source of truth. In this architecture all financial data is stored in one journal and accounting and controlling are commonly using the same chart of accounts and same posting objects. Thus, reconciliation between Financial Accounting (FI) and Controlling (CO) is much easier to do than in the former SAP systems. Cost of sales accounting is consequently also mapped in the Universal Journal (ACDOCA), what leads to a homogeneous view on functional areas for accounting and controlling. This means that functional area reporting can be modelled for Financial Statement, Profit-Centre-Accounting and Account-Based Margin Analysis, the latter is the new S/4Hana quasi-standard for SAP CO-PA, on the same database.

Usage of functional Areas for functional cost controlling in SAP S/4HANA

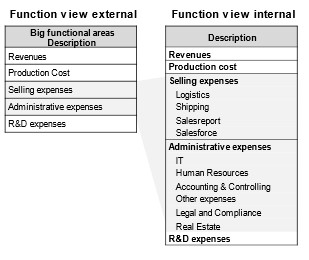

Technically a company is free to choose the level of detail of the SAP functional areas. For IFRS or local GAAP, the use of the big functional areas such as revenue, production costs, selling expenses, R&D expense and administrative expenses is generally sufficient. However, a detailing of these functional areas according to respective requirements of corporate management could increase the information content and enable further control options for e.g., internal P&L structure or functional cost controlling.

As shown in the following figure, for accounting requirements the big five functional areas maybe sufficient (function view external), but from the perspective of the controlling requirement (functional view internal), the detailing of the functional area levels serves a deeper functional logic in internal P&L reporting and functional cost controlling.

Figure 2: Function view external vs. internal

From a business management perspective, functional cost controlling is a part of operational controlling and includes the planning, control, and cost management of business functions such as IT, Marketing or HR. In many companies, the controlling of these functions is becoming more important because of higher complexity of corporate functions and increasing functional costs. But at the corporate level, there is often a lack of functional cost transparency, for example, due to decentralized management or inconsistent functional cost definitions. Hence, a structured and system-based functional cost controlling systematic could be valuable.

Generally, vital goals can be pursued with functional cost controlling. It helps companies to create a central and accountable cost control of global functions from a corporate perspective. Uniform, comprehensive, and consistent data structures and value flows contribute to standardized and consistent reporting of functional costs. Thus, companies have potential to increase cost efficiency.

To present the functional costs of a company more transparently, it is advisable to use functional areas in SAP S/4HANA as an instrument of functional cost controlling to present steering relevant functions. Structuring functional costs by these functional areas forms the data basis for active functional cost controlling and benchmarking. For this purpose, all controlling objects of the company must be clearly assigned to the functional areas. This applies to all cost centres, internal orders, projects, production orders, service orders, and customer orders. It is crucial that the objects only carry the values that relate to the assigned functional area, i.e., that they belong to the specific function. If, for example, a marketing cost centre also carries IT costs, these costs must be as allocated to a functional IT cost centre. Obviously, a rearrangement of the booking material is a necessary change within a functional cost controlling approach by functional areas.

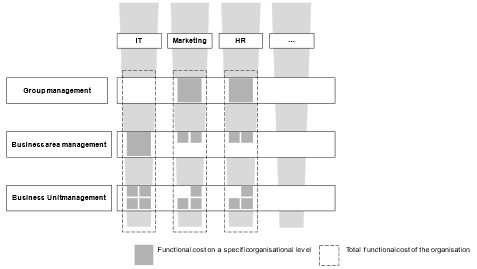

This structuring ensures a consistent and transparent functional cost view. Only in this way the functional costs of the steering relevant functional areas, as divided into IT, marketing and HR in the following figure, can be presented transparently across several organizational and legal units. Thus, the functions can be managed from a group perspective. Functional cost information can be reported on a standardized basis, time consuming ad-hoc analysis is no longer needed.

Figure 3: Functional costs in functional areas

Integration of functional areas into S/4HANA margin analysis

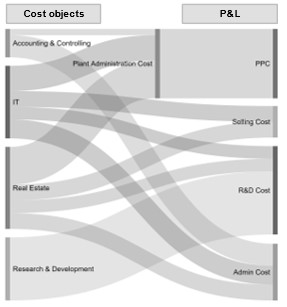

Companies have further advantages if they also use the functional areas of the functional cost concept to structure the line items of internal P&L reporting in S/4HANA margin analysis. As you can see in the following illustration, there is a consistent analysis path from resource view (cost at source) to P&L (cost at destination) and vice versa on a document level possible, because these value flows are completely in the Universal Journal (single source of truth).

Figure 4: From a resource view to P&L view

Moreover, this logic also facilitates the reconciliation of the internal P&L with the external P&L as functional areas for cost controlling are so designed so that they can be aggregated to the functional view needed in legal cost of sales reporting.

Additionally, within such a concept and if the steering model waives mostly on cross-functional allocations, the new S/4HANA functionality “attributed segment” in Account Based Profitability Analysis (Margin Analysis) opens the way to a scenario where companies can remove allocation cycles to margin analysis, because the relevant data can already be derived at the time of posting. The goal of a real-time P&L reporting is no longer out of reach.

If you want to get more information on Functional Cost Controlling in SAP S/4HANA, feel free to contact Andy Draxinger (andy.draxinger@www.draxingerlentz.de).

Would you like to receive curated information on current topics in finance and controlling? You can subscribe to our newsletter here and become an insider!