Margin Analysis in SAP S/4HANA

SAP S/4HANA makes account-based profitability analysis the new standard tool for profitability analysis

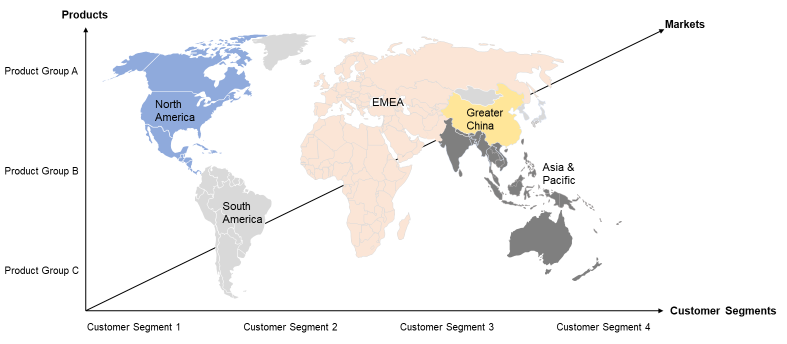

It is essential for companies to have P&L information that is meaningful and understood within the organisation, both for the internal management view and for external segments such as markets, customers, and products. As shown in the following figure, these requirements represent the need for transparent multidimensional P&L reporting.

Figure 1: Multidimensional P&L reporting

Hence, flexible and designable multidimensional profitability analysis views are necessary to support management`s decision-making and increase competitiveness. It helps companies to assess market segments and their aggregations or business units in terms of their contribution margin or other defined relevant KPIs up to EBIT level. Market segments can, for example, be detailed according to products or customers. Summarizations can be, for example, sales organizations or business units. Moreover, steering questions like landed cost margin can also be answered with such a reporting model.

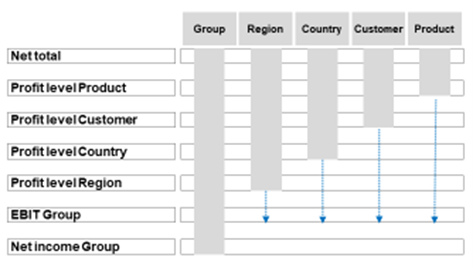

Figure 2: Exemplary reporting model

Technically for that purpose, SAP offered already in SAP ECC the so-called Controlling-Profitability-Analysis (CO-PA). There, profitability analysis comes in two forms, cost-based and account-based. Only the cost-based method was used regularly within companies, but often with many points of criticism. Where on the one hand the account-based method in SAP ECC was too inflexible, the reporting system of the cost-based method was too slow and there were also numerous reconciliation requirements with the accounting department due to the different approaches (accounts in financial accounting vs. value fields of cost-based CO-PA). For instance, in cost-based CO-PA, the cost of goods sold were updated during billing and not at delivery while they were updated immediately in FI.

In the cost-based profitability analysis, costs and revenues are grouped according to value fields. Value fields organize the specific value flows into the P&L according to the P&L reporting design. Normally, the value fields bundle several accounts and there is mostly no direct link to the accounts of financial accounting. In addition, depending on the controlling approach, the cost-based profitability analysis with imputed valuations (e.g., statistical sales deductions). This leads to the mentioned difficulties in reconciliation between external and internal accounting. Contrary, account-based profitability analysis in SAP ECC does not use value fields but stores costs and revenues in accounts. All P&L accounts must be created as additional cost elements. In account-based CO-PA, incoming sales order data could not be mapped, and a cost component split was not possible. Further, variance analysis was not available. Thus, most companies preferred cost-based CO-PA over account-based CO-PA in SAP ECC. However, as aforementioned, cost-based CO-PA displayed performance issues, which made it necessary to additionally refer to other tools. The use of SAP BW or other comparable tools at least remedied the problem of reporting speed somewhat but not the difficulties in reconciliation between Finance and Controlling. Thus, the more important external reporting became for a company because of external stakeholder requirements the more problematic these reconciliation aspects became.

Margin Analysis in SAP S/4HANA harmonizes financial accounting (FI) and management accounting (CO)

With the introduction of SAP S/4HANA, SAP aims to resolve the disadvantages and problems of profitability analysis in SAP ECC. Therefore, the introduction of SAP S/4HANA resulted in many changes in profitability analysis. Previously, account-based profitability analysis was only available with a few functions. As the focus in SAP S/4HANA now shifts to the account-based profitability analysis and relies on the Universal Journal as one single source of truth, Margin Analysis is now more transparent, easier to use and meets the requirements for efficient management reporting. However, cost-based profitability analysis is still applicable in SAP S/4HANA, but not recommended. The greater reconcilability between the formerly separate FI and CO modules is one of the biggest advantages of S/4HANA within Margin Analysis.

SAP S/4HANA delivers significant performance improvements for the Margin Analysis

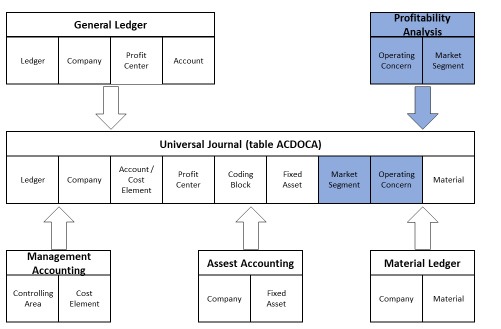

Through the usage of the Universal Journal, a 1:1 view is now provided for the data as only one table (ACDOCA) is the source for reporting purposes (single-source-of truth). Therefore, report creation with S/4HANA is now way faster while multi-dimensional views are possible.

Figure 3: Profitability Analysis included in the universal journal (table ACDOCA)

The new capabilities of account-based profitability analysis in S/4HANA require a re-evaluation of a company’s BI strategy

With the new capabilities of account-based profitability analysis, a new approach is possible in CO-PA, decision-makers should therefore re-evaluate their BI strategy to the new circumstances. Especially if, due to the lack of functions in SAP ECC, BI reporting structures were set up to bypass these missing functionalities, these structures should now be reviewed and realigned under consideration of the Universal Journal as a single source of truth when using SAP S/4HANA. This can potentially lead to cost savings and faster and simpler reporting processes. Further, through the multidimensional view, e.g., the management responsibility view in form of Profit Center Accounting can be seamlessly integrated as a steering dimension in the margin analysis. Balance sheet KPI’s can be also used in Margin Analysis. These led to the possibility to integrate internal responsibility management reporting with the outward-orientated view of CO-PA. Therefore, existing KPIs and steering structures should be realigned to the new capabilities and concluded in a reporting strategy.

Integrated COGS value flow

An important new function of account-based profitability analysis is the possibility of COGS-split. This means that cost of goods sold can be split into the cost items according to the cost component structure. This enables a detailed analysis of the cost of goods sold in financial accounting and margin analysis and supports corporate management by providing a differentiated view of the cost drivers. As a result, better decision-making for product costing or pricing, for example, is possible. Furthermore, this new capability provides a better view of deviations in production and transparency is also increased through the possibility to integrate actual costing into this logic.

Gaining predictive insights through extension ledger in SAP S/4HANA

Extension ledger also is a new functionality within S/4HANA and offers different possibilities for predictive, simulation, or adjustment postings in addition to the main ledgers. Extension ledger is a general S/4HANA technology. A special use case for Margin Analysis is prediction functionality based on sales order data. Every time a sales order has been created the system simulates the follow-on documents, e.g., billing documents, and creates predictive journal entries in an extension ledger. Subsequent finance processes such as splitting of costs of goods sold are also triggered and all corresponding documents are displayed in the system as if they were real data. Through this, financial managers can gain predictive insights into their financial accounting and can plan accordingly. Hence, essential steering information is available at an earlier stage.

In the extension ledger, only differences between valuations are posted while it must have a standard ledger assigned as an underlying ledger. Extension ledgers, which must be activated explicitly, are flexible to use as they can be set up quite easily and do not require data migration. Postings in the extension ledger are also displayed in the ACDOCA table.

Real-time derivation in margin analysis in SAP S/4HANA

The new account-based profitability analysis in SAP S/4HANA allows the derivation of market segments from cost centers and orders directly when posted leading to a richer and more relevant state of data in profitability analysis over the period. For this direct attribute assignment, the powerful derivation method of CO-PA is available. It is now possible to gain business insights in real-time making reports more powerful and reliable. In SAP ECC, the derivation of CO-PA characteristic and profitability segment is not possible in real-time. First, expenses and revenues had to be posted on internal orders or customer orders and then the settlement from these objects to CO-PA had to be done. Similarly, overhead costs required the posting of expenses to cost centers and then had to be settled at the period-end closing. Thus, the profitability analysis in SAP ECC was not complete until these missing values and overhead costs were transferred into CO-PA. A real-time view of a company’s financial data through CO-PA was not possible.

How to sufficiently exploit the full potential of SAP S/4HANA Margin Analysis

The new opportunities in S/4HANA make the Margin Analysis more powerful and reliable which is why managers should not miss out on it. However, some pitfalls could lead to failure and result in an inadequate usage of the new possibilities. With our experience, we recommend decision-makers strategically approach the conversion. When setting up a margin analysis, particular attention must be paid to three things. Margin analysis must be aligned to the steering model and value flows must be aligned with the P&L statement. It is, therefore, crucial to consider steering principles and derive design principles. In addition, companies must deal with cost-accounting costs which used to run as one value-flow into CO-PA. Also, sales deductions such as rebates or bonuses must be coordinated specifically.

If you want to get more information on Profit Center Accounting in SAP S/4HANA,feel free to contact Andy Draxinger (andy.draxinger@www.draxingerlentz.de).